Essential Web3 Trading Tools

The most effective platforms for on-chain trading success

Trading Terminals and MEV Protection

In on-chain trading, having the right tools can mean the difference between capturing alpha and being front-run by bots. These specialized trading platforms offer features specifically designed for Web3 trading environments, providing MEV protection, real-time data, and efficient execution.

There are many tools outside the one I listed here, but these are the tools that I most frequently used and I found these tools sufficient enough to sustain my operation.

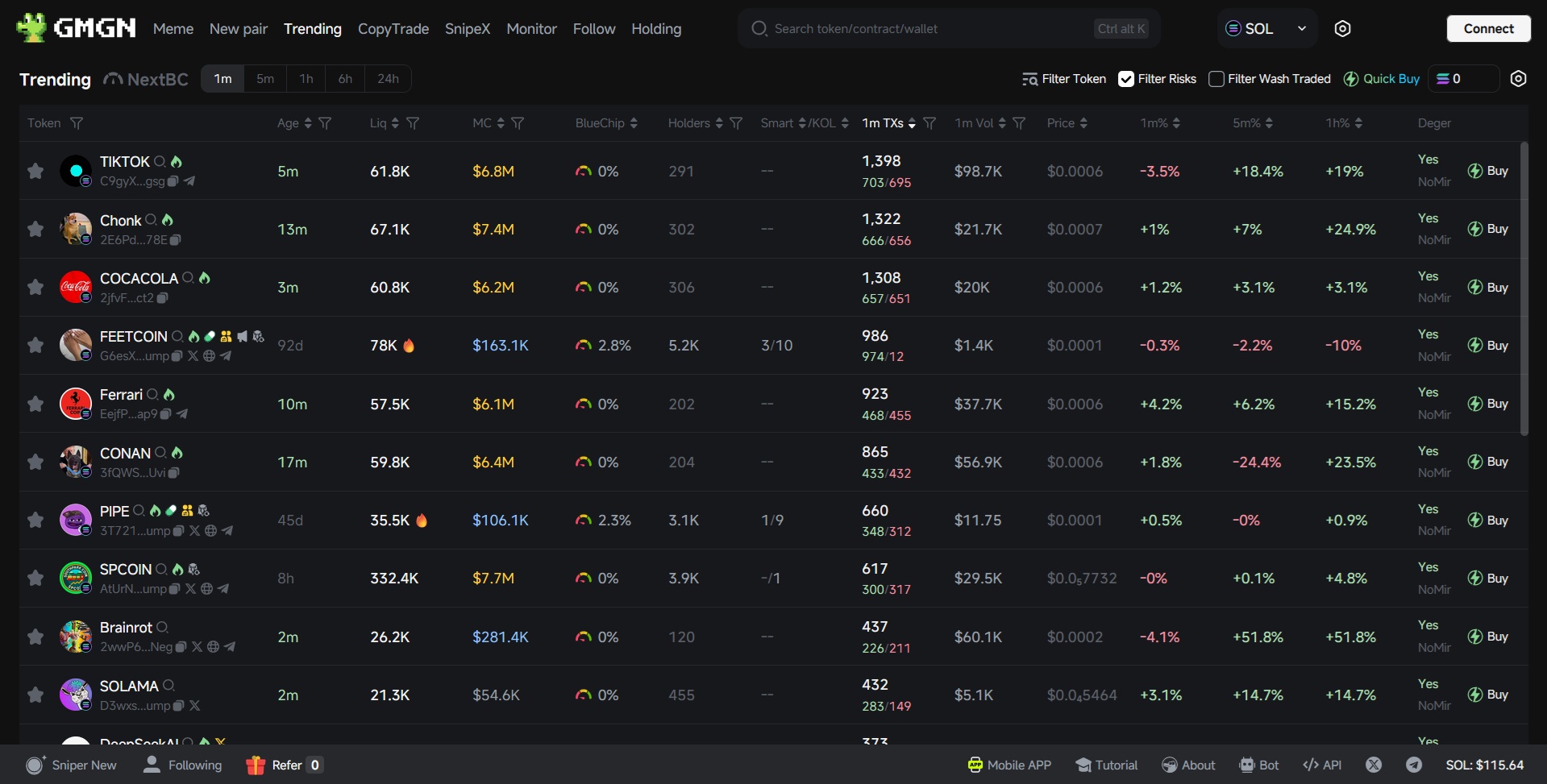

GMGN.ai Trading Terminal

A comprehensive trading terminal focused on token discovery and real-time market monitoring with integrated MEV protection.

Key Features:

- Real-time trending token tracking

- My Go-to when looking for potential small-cap play

- Detailed token information including market cap, liquidity, and holder data

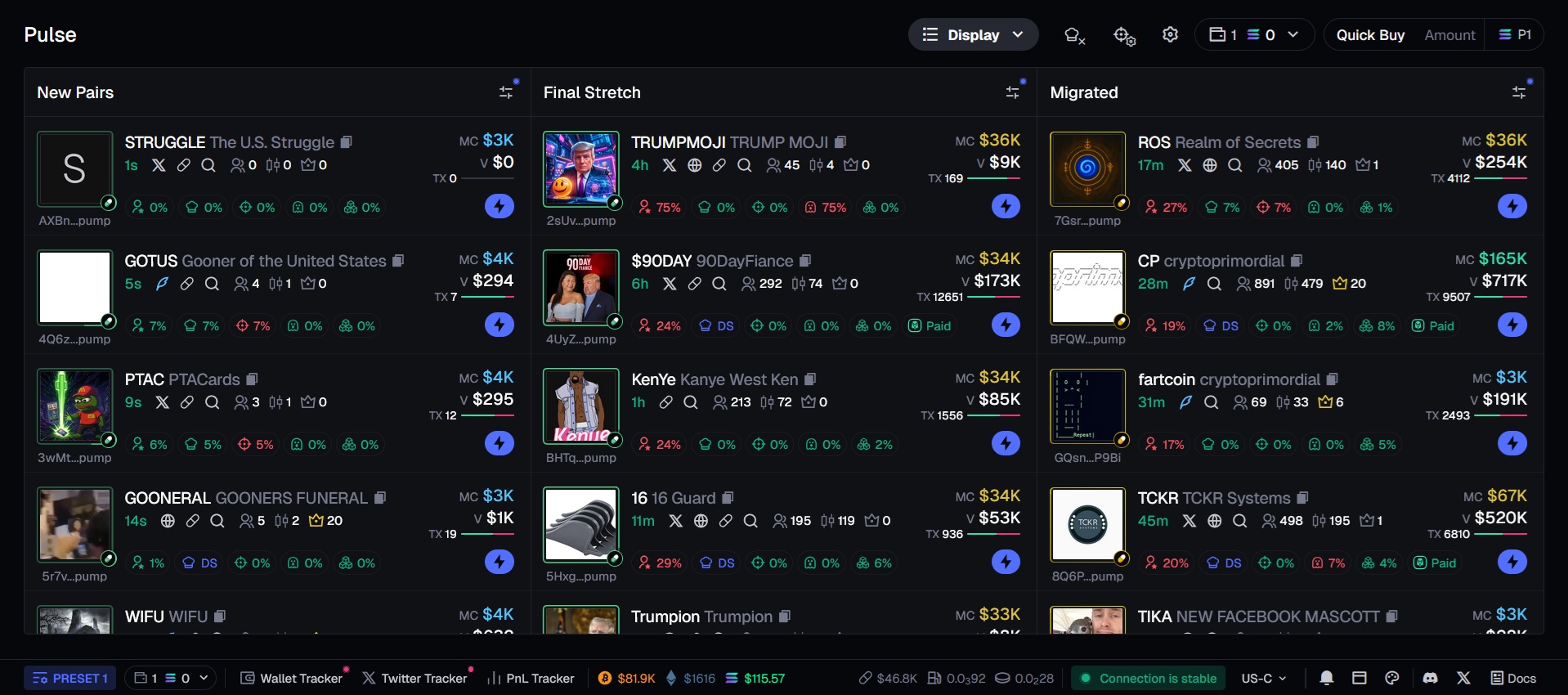

Axiom Trading Interface

While GMGN can also be used as a trading interface, I prefer Axiom for the trade execution.

Key Features:

- New pairs discovery dashboard

- "Final Stretch" and "Migrated" token categories

- Detailed trading metrics and indicators

- Quick Buy functionality with amount settings

RickMarket Analytics

Very easy to use bot in Telegram to check on token status.

Key Features:

- Easy to use, just paste contract address to your telegram

- Detailed token metrics including FDV and ATH comparisons

- Useful for both individual and groups

- Support for multiple exchanges and DEXs

Trading Security Note

When using any Web3 trading tool, always:

- Use a separate wallet with limited funds for active trading

- Verify contract addresses before approving any transactions

- Be cautious about token approvals - limit permissions when possible

Getting Started With On-Chain Trading Tools

For those new to on-chain trading, here's a simple process to get started:

- Select your primary chain - Focus on chains with high liquidity like Ethereum, BNB Chain, or Solana. This guide assume you will be using Solana.

- Connect to multiple trading tools - Each tool offers different advantages; using them in combination provides the most complete market view

- Start with small positions - Build familiarity with the tools before committing larger capital

- Utilize MEV protection - Whenever possible, enable MEV protection to prevent front-running and sandwich attack

- X/Twitter should be your main sentiment gauge - 99.9% On-chain token went to zero after some time. Get in early, watch the social sentiment, get out, profit. Rinse and repeat.

Remember that on-chain trading is highly social - staying connected to community channels and monitoring social sentiment can provide valuable trading signals beyond what technical tools can offer.